This feature requires Paladin integration with QuickBooks. When you have this integration turned on, vendor bills are automatically created in QuickBooks shortly after you receive inventory in Paladin. An invoice is created for each receiving event. If you receive items on a purchase order incrementally, a QuickBooks bill is created each time you receive items on the purchase order.

Note: QuickBooks Online and Desktop Integration’s PO data set sends line item data instead of Purchase Order totals; it doesn’t just create a single lump total, you can see every individual item received on the PO, the qty’s, and individual totals.

To learn more about the integration. see Overview: QuickBooks integration.

To get started, contact Paladin Support.

QuickBooks vendor bills are created for items that are received manually or via EDI. A vendor bill is created for every receiving event; therefore, if you receive a purchase order in parts over time, a vendor bill is created for each partial receiving event.

As part of the PO transfer, Paladin looks for a vendor in QuickBooks that matches the supplier name in Paladin. If one is not found, a new vendor is created in QuickBooks.

Tip: To prevent duplicate vendors, make sure that supplier names in Paladin exactly match your vendor names in QuickBooks.

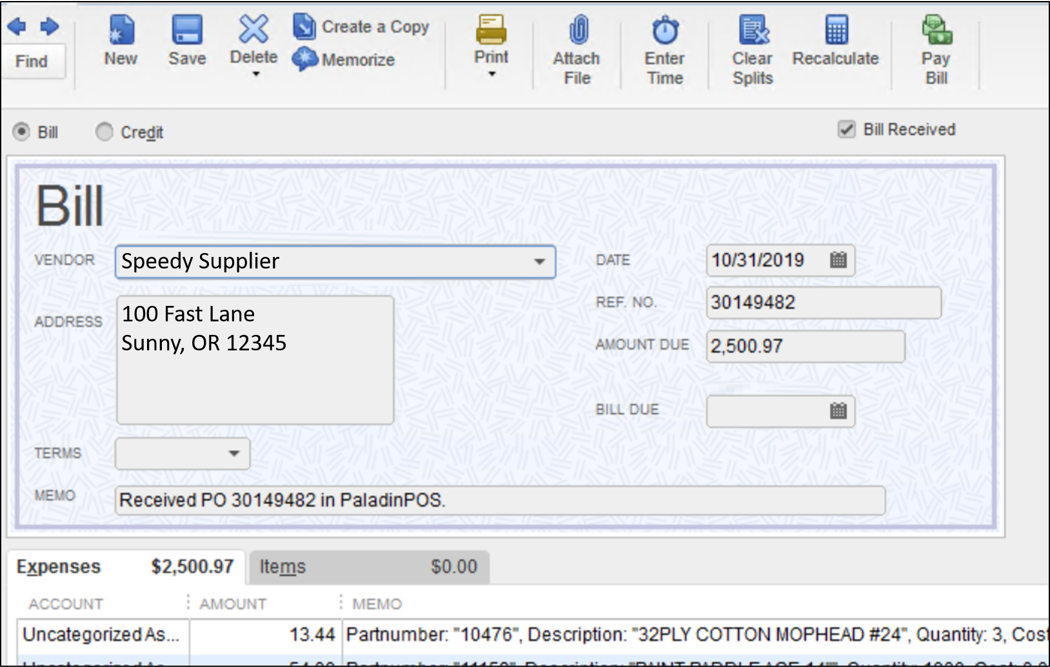

In QuickBooks, the vendor bill includes the following order details:

- VENDOR (supplier) shows the details from Paladin.

- DATE is from the Apply Freight Cost window.

- REF NO. is set to the Supplier Invoice Number that you entered when you received the PO. If you did not specify a Supplier Invoice Number, the Paladin purchase order number is used.

- AMOUNT DUE from the purchase order.

- MEMO references Paladin and includes the purchase order #.

Figure 1: Vendor bill

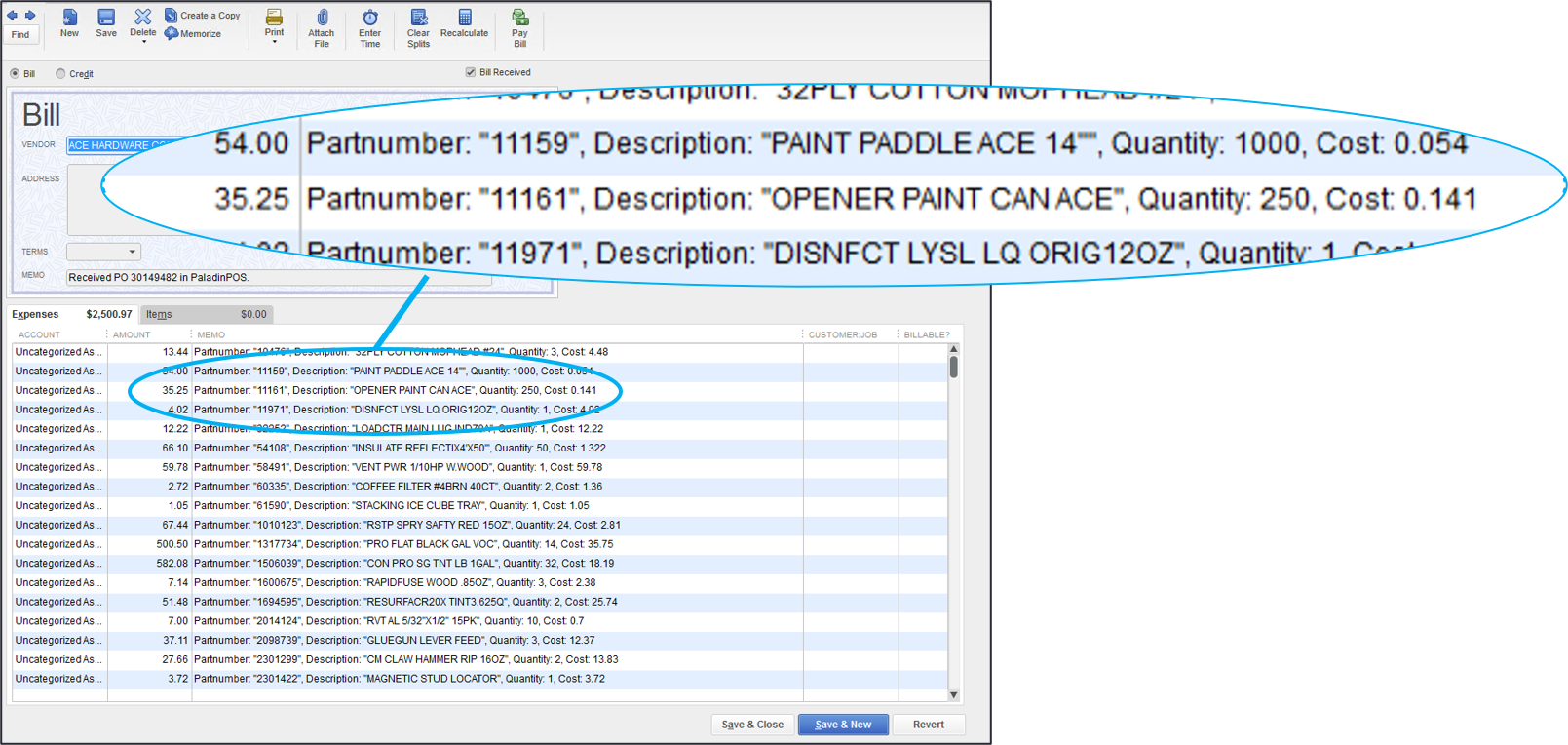

The bill also includes a list of received line items, including part number, description, cost, quantity, and line item extension (amount due per item).

Figure 2: List of received line items

Important:

- When use this feature to create vendor bills, the corresponding received purchase order debits are excluded from the day’s general ledger inventory asset amount. This will prevent duplication of these debits in QuickBooks. Because of this, the inventory received amount in the Receiving Report (Paladin’s Reports module: Inventory > History > Receiving Report) will not match the general ledger Inventory Asset account. Instead, it will appear as vendor bills.

- When the QuickBooks integration has vendor bills enabled, the user can enter an alphanumeric “Supplier Invoice Number,” which will show in QuickBooks as the REF NO. They can also change the invoice date to reflect the time the vendor received the invoice.

Note: If the invoice date is different from the date the PO was received in Paladin, the vendor bill in QuickBooks will have a different date than the received date in Paladin.

- If you use the PO transfer feature, you will need manager credentials to reverse the purchase order (undo receiving), and you will have to manually remove the corresponding vendor bill from QuickBooks.

If you have questions or suggestions about this information, contact support@paladinpos.com.