With Automated Check Handling (ACH), clients can save time and seamlessly process checks with electronic bank account deposits. When a customer pays by check, this time-saving feature transfers the transaction amount overnight using the customer’s bank account information on file or check information entered at checkout.

During invoicing, if a customer is selected, check information must only be entered once. Afterwards, it is saved in Paladin for future purchases.

Paladin offers the following electronic check deposit integration:

- Wells Fargo SAFE.

Note: The client MUST enroll with Wells Fargo before Paladin can provide integration.

Note: For clients that want to use Automated Check Handling (ACH) without integration with Wells Fargo, refer to: Accounting: Automate Check Handling option

This article provides instruction and information on the following:

How electronic check deposit works

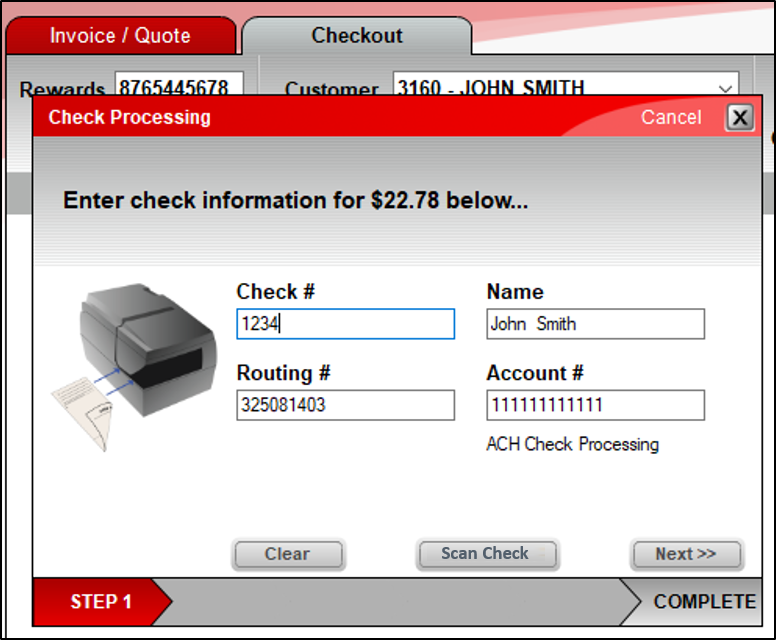

During invoicing, when a customer pays by check, the following information is collected in Paladin’s Invoice/Quote module’s Check Processing window:

- Check #: The check number

- Name: The name on the check

- Routing #: The bank routing number

- Account #: The bank account number

When the Check Processing window opens, scan the check with your endorsement printer. The information will be filled in automatically. If you don’t have an endorsement printer, manual entry will be required.

Tip: Endorsement printers save time and ensure that banking account information is entered correctly. They also print your endorsement on the back of the check. To learn more about Paladin-supported endorsement printers, contact Paladin Support (1-800-725-2346, option 2 or support@paladinpos.com).

Figure 1: Check Processing window

If the customer’s bank information is on file, it will automatically appear in the Check Processing window.

Important: Always verify bank account information on file with the customer or compare the information with the check presented as payment.

Click Next and complete the transaction:

- The money will be deposited in your store’s bank account overnight.

- If a customer was selected in Paladin during invoicing, the check information will be saved under their name. The next time the customer pays by check, the saved bank account information automatically appears in the Check Processing window.

Adding bank account information in the Customers module

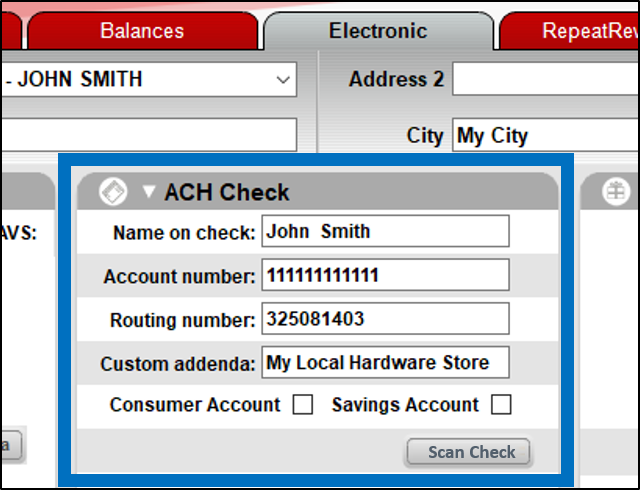

You can also scan or enter a customer’s bank account information in Paladin’s Customers module, on the Electronic tab, in the ACH Check pane.

This ACH Check pane includes these additional settings:

- Custom addenda [Wells Fargo SAFE]: Enter a note to attach to each transaction.

- Consumer Account and Savings Account: By default, ACH bank account information is assumed to represent a business checking account. This default setting is not visible and does not have a checkbox. If the account is a consumer account or savings account instead of a business checking account, select the appropriate checkbox in the ACH Check pane shown in Figure 2..

Figure 2: Customers module/Electronic tab/ACH pane

If you have questions or suggestions about this information, contact support@paladinpos.com.