This article provides instruction and information on setting up California 1 percent (1)% Lumber tax.

Creating a department

- In Paladin, from the main menu, select File >Setup.

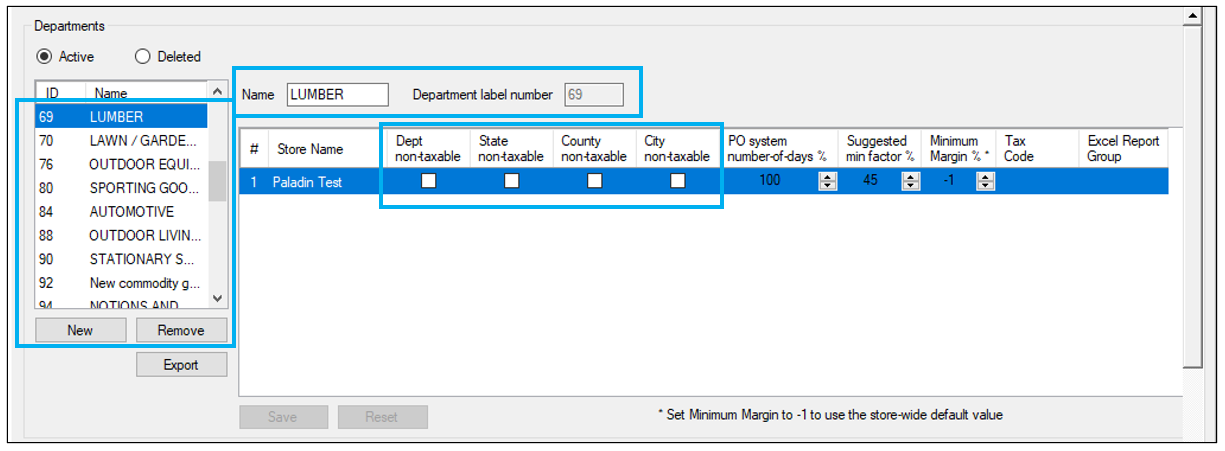

- Select the Dept tab.

- Under the ID and Name field, click New.

- In the Name box, enter LUMBER.

- Enter a number in the Department label number box. For this article, 69 is used.

- In the field under the Name box, make sure all the non-taxable boxes are unchecked.

- Click Save.

Figure 1: New Department setting

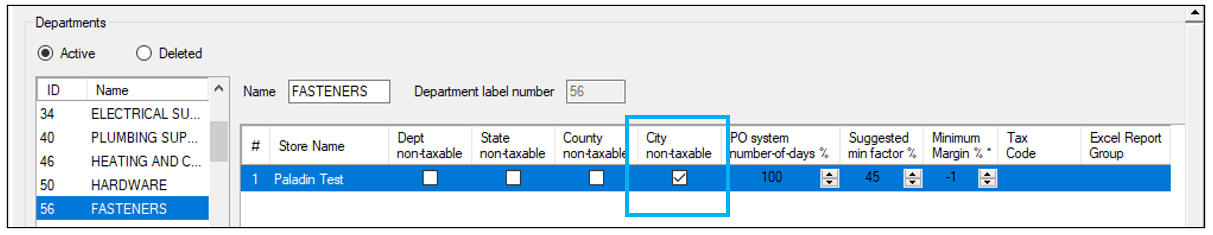

- Go through each of the remaining active departments and make sure all have the City non-taxable box checked.

Figure 2: City non-taxable checkbox

- Click Close.

Assigning the department

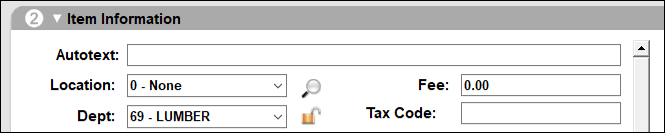

- In Paladin, on the top ribbon, select the Inventory module.

- Select the General tab.

- In the Item Information pane, assign the newly created LUMBER department code to all qualifying taxable lumber items by selecting the department you created from the Dept: list.

Figure 3: Department assigned

- Click F12 Save, then exit out of the Inventory module.

Assigning tax definitions

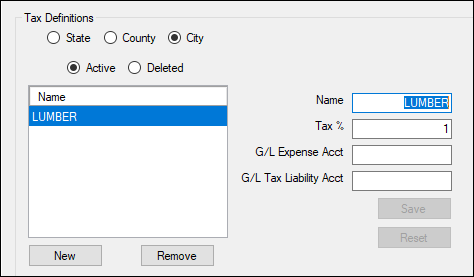

For California Lumber tax, only a city tax needs to be created.

- In Paladin, from the main menu, select File > Setup.

- Select the Taxes tab.

- In the Tax Definitions pane, click New.

- In the Name box, enter LUMBER.

- Enter 1 in the Tax % box.

Figure 4: Tax Definitions/LUMBER

- Click Save.

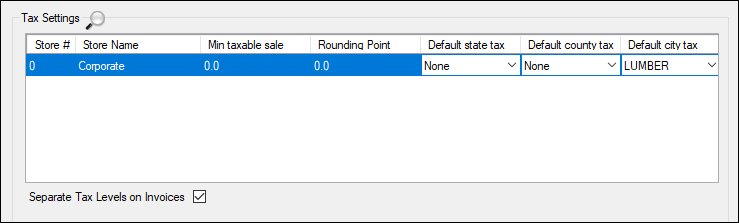

- Under the Tax Settings pane, set the Default City tax to LUMBER.

- The state of California requires that the lumber tax amount be shown on the receipt. Therefore, check Separate Tax Levels on Invoices.

Figure 5: Tax Settings/Default city tax

- Click Close.

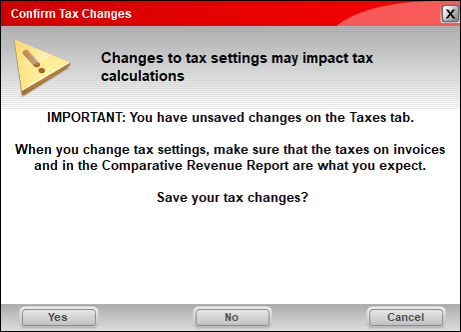

- The Confirm Tax Changes window opens.

Figure 6: Confirm Tax Changes window

- Click Yes.

If you have questions or suggestions about this information, contact support@paladinpos.com.

*Content is subject to change. For the most recent version, visit the Help Portal.

Printed on: 7/07/25