This article provides instruction and information on setting up California Agriculture exemption tax.

- Creating a department

- Assigning the department

- Assigning tax definitions

- Assign agriculture tax exemption to all qualifying clients

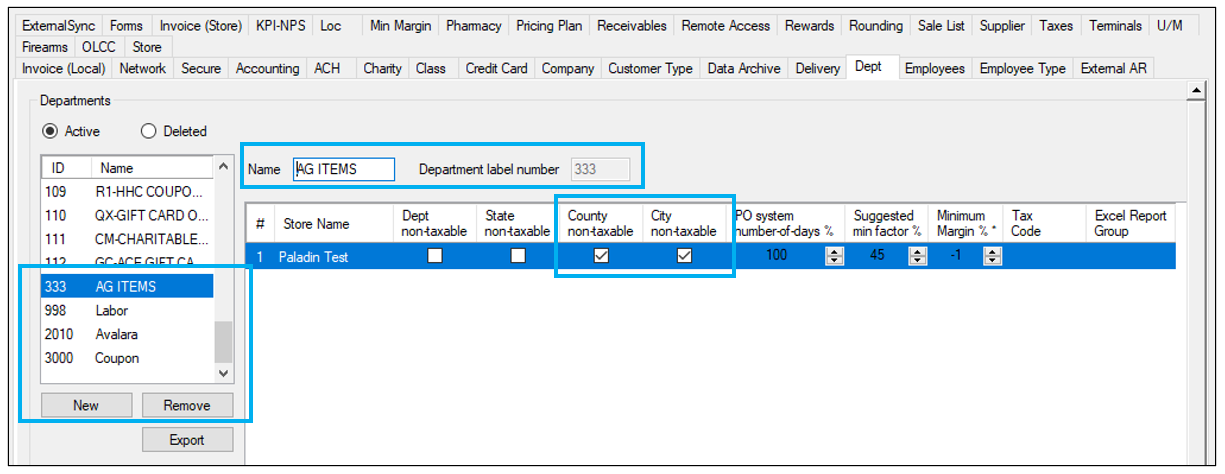

Creating a department

- In Paladin, from the main menu, select File > Setup.

- Select the Dept tab.

- Under the ID and Name field, click New.

- In the Name box, enter AG ITEMS.

- Enter a number in the Department label number box. For this article, 333 is used.

- In the field under the Name box, check County non-taxable and City non-taxable.

- Click Save, then click Close.

Figure 1: New Department setting

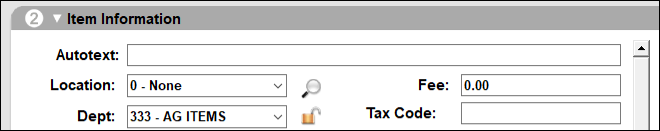

Assigning the department

- In Paladin, on the top ribbon, select the Inventory module.

- Select the General tab.

- In the Item Information pane, assign the newly created AG ITEMS department code to all qualifying tax-exempt agricultural items by selecting the department you created from the Dept: list.

- Click F12 Save, then exit out of the Inventory module.

Figure 2: Department assigned

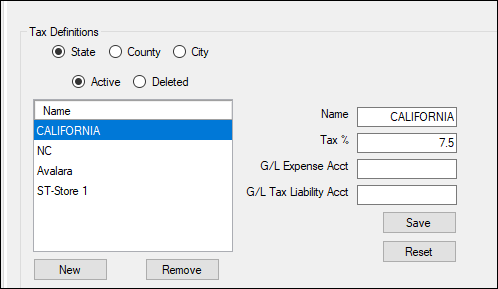

Assigning tax definitions

To create state and county tax rates:

- In Paladin, from the main menu, select File > Setup.

- Select the Taxes tab.

- In the Tax Definitions pane, create a State tax labeled CALIFORNIA and set the percentage to the combined state and county taxable rate for the store’s location. It’s typically somewhere between 7.25% and 10.5% depending on the geographical location. For this article, we will use 7.5% as our combined state and county tax rate.

- Enable State.

- Click New.

- In the Name box, enter CALIFORNIA.

- Enter 7.5 in the Tax % box.

Figure 3: Tax Definitions/CALIFORNIA

- Click Save.

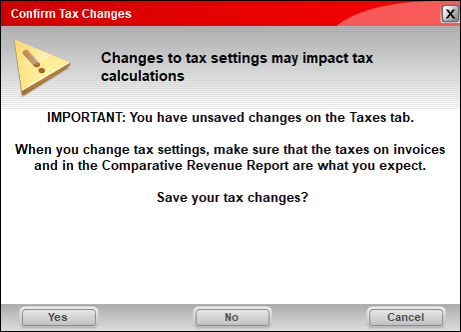

- The Confirm Tax Changes window opens.

Figure 4: Confirm Tax Changes window

- Click Yes.

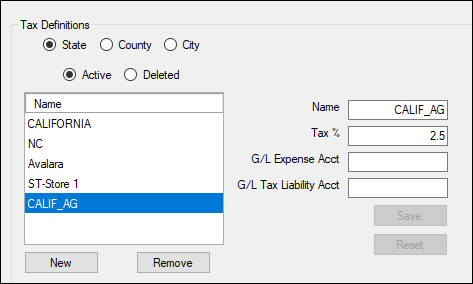

- Using the same steps above, create a second State tax labeled CALIF_AG and set the percentage to the total of the CALIFORNIA tax rate less the 5% agricultural exemption. In this case the amount would be 2.5%. Formula: 7.5% – 5% = 2.5%.

Figure 5: Tax Definitions/CALIF_AG

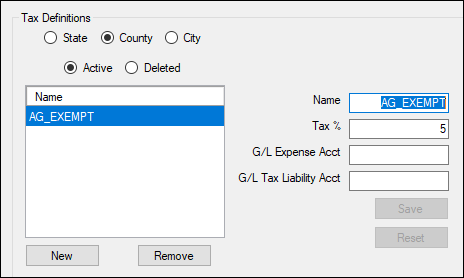

- Using the same steps above, but enabling County, create a County tax labeled AG_EXEMPT and set the percentage to 5%, or the amount equal to the agriculture exemption amount.

Figure 6: Tax Definitions/AG_EXEMPT

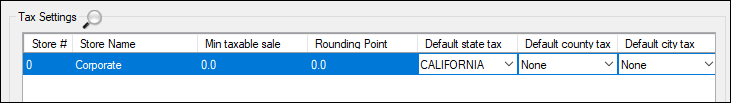

- Under the Tax Settings pane, set the Default State tax to CALIFORNIA, and set the Default County tax to None.

Figure 7: Tax Settings/Default State tax/Default County tax

- Click Close.

- The Confirm Tax Changes window opens.

- Click Yes.

Assign agriculture tax exemption to all qualifying clients

- In Paladin, on the ribbon, select the Customer module.

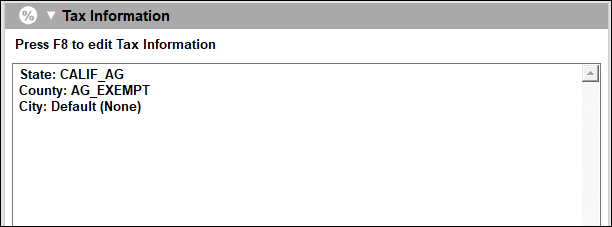

- Press F8 to edit tax information.

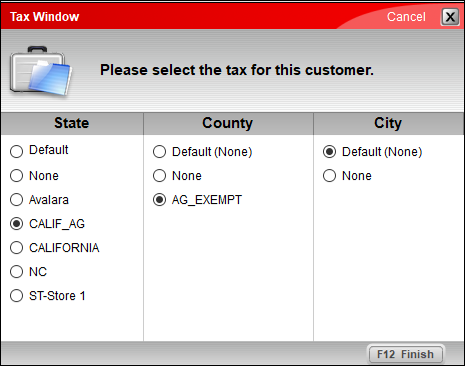

- In the Tax Window, set:

- State: CALIF_AG

- County: AG_EXEMPT

- City: Default (None)

Figure 8: Tax window

The information is reflected under the Tax Information pane.

Figure 9: Customers module/Tax Information

- Click F12 Save, then exit out of the Customers module.

- In Paladin’s Invoice/Quote module, test and verify the following taxable amounts.

No customer selected in invoicing:

-

- Regular items show a 7.5% tax

- Agriculture items show as a 7.5% tax

Customer is selected in invoicing that qualifies for agriculture exemption:

-

- Regular items show a 7.5% tax

- Agriculture items show as a 2.5% tax

If you have questions or suggestions about this information, contact support@paladinpos.com.

*Content is subject to change. For the most recent version, visit the Help Portal.

Printed on: 4/26/24