The Account Summary Report now auto-generates when month-end statements are run. With this, the report will not be available until the after the statement run.

Note: All information in the Account Summary report is pulled from the Customer account settings in Paladin. No other configuration parameters are necessary.

To access the report after month-end statements have run:

- In Paladin, on the top ribbon, select the Reports module.

- On the bottom ribbon of the module, select F10 Recall Reports.

- In the Recall Reports pane, select your report.

- Click F12 Recall.

A PDF file of the report opens.

Note: If an Account Summary report cannot be found, perform the following:

- In Paladin, on the top ribbon, select the Reports module.

- In the Report Area pane, select Accounts Receivable > Statements.

- In the Report List pane, select Month-End Statements.

- In the Choose Report pane, click F12 Next.

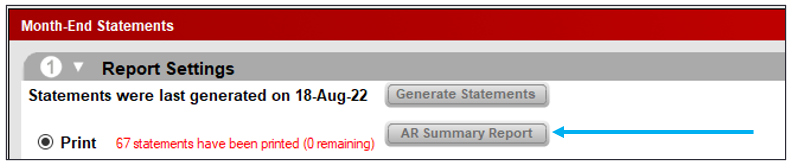

- In the Month-End Statements window, under the Report Settings pane, click AR Summary Report.

Figure 1: AR Summary Report button

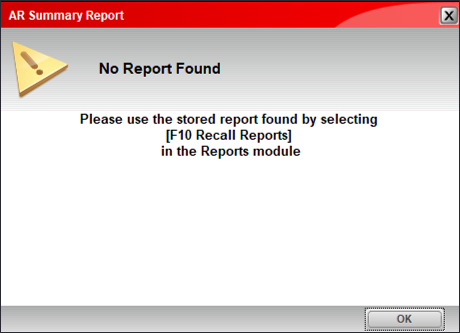

- The AR Summary Report message window opens providing instruction.

Figure 2: AR Summary Report message window

The following totals appear for all customer accounts at the end of the report:

-

Taxable Sales: Total of all taxable sales that were charged to a customer account.

Important: This value includes the Sales Tax Applied total (see description below). - Non-Taxable Sales: Total of all non-taxable sales charged to a customer account. Non-taxable sales include:

- Purchased items that are marked Non-taxable in the Inventory module > Pricing tab by clearing the Taxable checkbox.

- Purchased items that were marked non-taxable at checkout by clearing the Tax checkbox for that line item.

- Purchases that did not incur a tax because of the customer’s tax settings.

- Purchases that did not incur a tax because the tax settings were changed at checkout via the Tax [F6] feature on the bottom ribbon.

-

Partial Payments: Total of all payments made that were less than transaction total. For example, if a customer charged $10.00 to their account, and they made a payment of $7.00, $7.00 will be added to this total.

-

Unused Payments: Total of customer payments that were greater than the transaction total. For example, if a customer charged $10.00 to their account and made a payment of $15.00, $5.00 will be added to the unused payment total.

-

This amount does not include returns.

- This amount does not reduce the Taxable or Non-Taxable totals.

-

-

Service Charges: Total amount of service charges that were applied to past due balances when you run statements.

-

Sales Tax Applied: Total amount of sales tax collected.

Important: The Sales Tax Applied amount is included in the Taxable Sales total described above.

If you have questions or suggestions about this information, contact support@paladinpos.com.