Many states have enacted regulations that require inventory item-specific charges. This is done to help reduce items being improperly left in landfills and to encourage recycling and reuse of materials (aluminum cans, glass bottles). These charges are referred to as a core charge, which is a fee that is automatically included with the item on an invoice. The most common core charges are for:

- Batteries (Core Charge)

- Pesticides (Pesticide Fee)

- Paint Recycle (Paint Fee)

- Can/bottle Recycle (Recycle Fee)

In Paladin, stores now specifically name a core charge to make clear the government requirements.

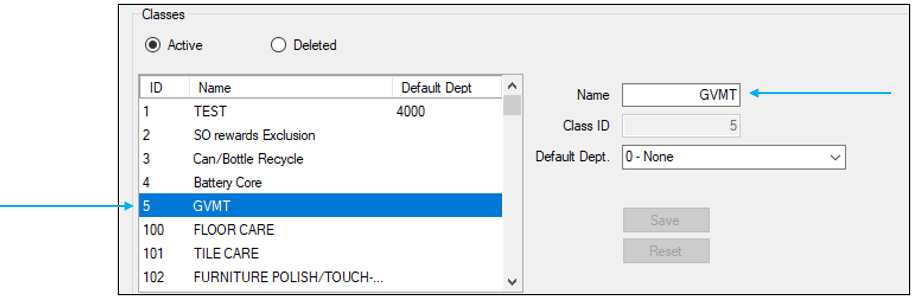

To set the name of a core charge:

- In Paladin, from the main menu, select File > Setup.

- Select the Class tab.

- In the Classes pane, click New.

- Enter GVMT for the class in the Name box.

- Enter an ID in the Class ID box.

- Click Save.

Figure 1: Class name

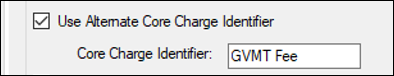

- Select the Invoice (Store) tab.

- In the Invoice pane, check Use Alternate Core Charge Identifier.

- Enter GVMT in the Core Charge Identifier box.

Note: Using GVMT (for Government) covers all possibilities (battery, bottle/can deposit, paint, etc.). A clearer description of the core charge can be given in the Autotext box of the General tab in the Inventory module.

Figure 2: Core Charge Identifier

- Click Save, then click Close.

- Close and restart Paladin.

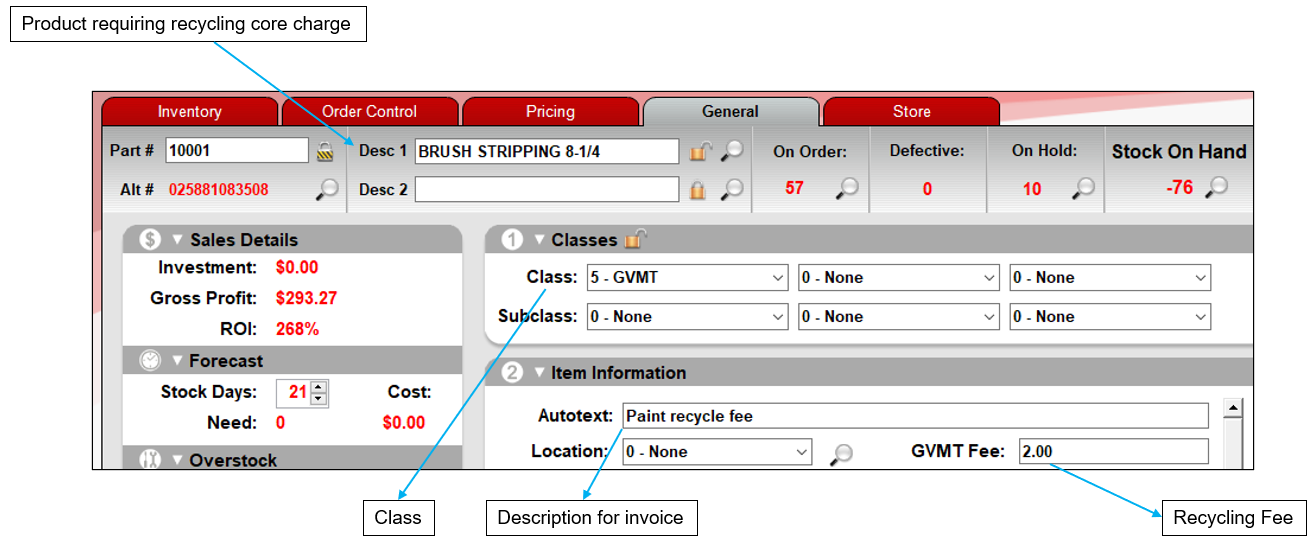

- Specify the core charge class for an item on the General tab in Paladin’s Inventory module.

Note: Adding a description in the Auto text box is recommended so that a description is shown on the invoice.

Figure 3: Paladin Inventory module/General tab/Core charge fields

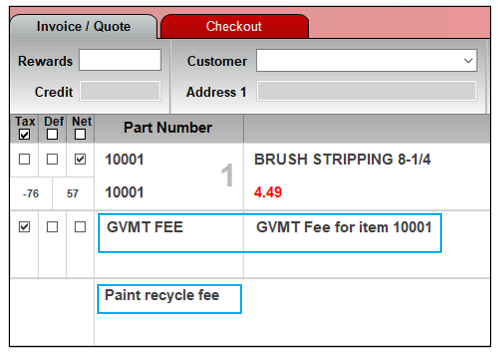

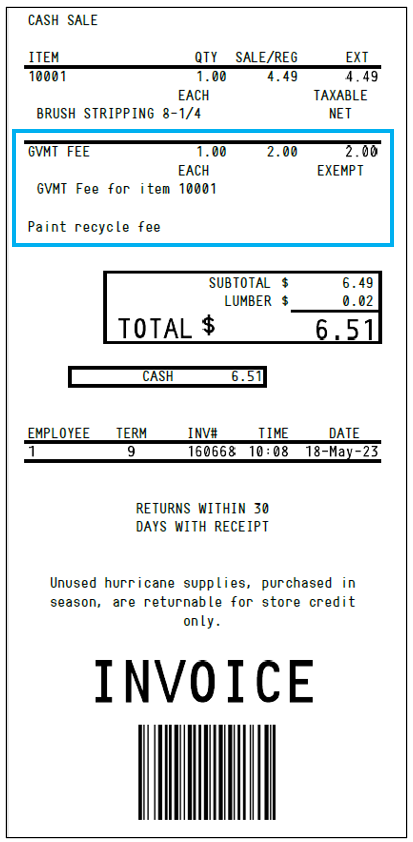

When making an order in Paladin’s Invoice/Quote module, anytime an inventory item that has a “core charge” associated with it, the invoice automatically displays the secondary core charge for the item with the updated label name. The core charge appears on a separate line, and the description of the fee appears on a separate Notes line.

Figure 4: Core Charge Identifier and Class note

On the purchase invoice, lines are added for the core charge identifier and fee as well as the description of the fee.

Figure 5: Core Charge and description on invoice

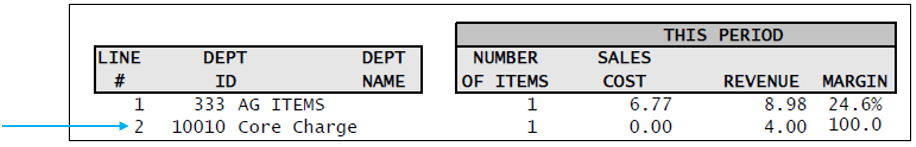

Any core charges used under all identifiers will total on a Comparative Revenue report.

Figure 6: Core Charge in Comparative Revenue report

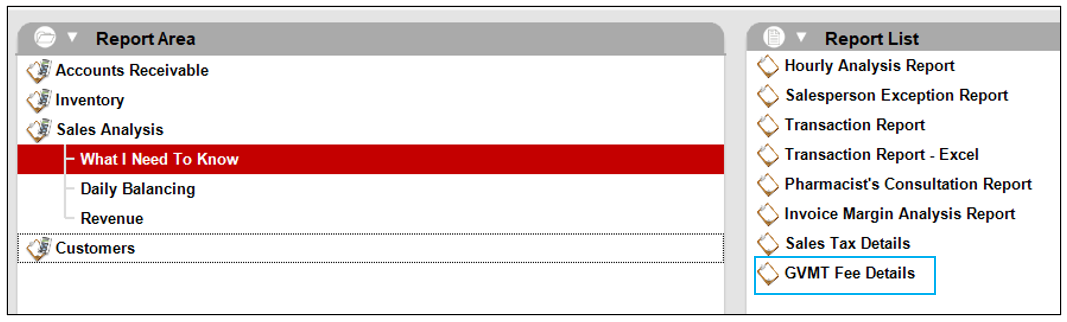

In Paladin’s Reports module, in the Report List pane, GMVT Fee Details is listed. It is also referred to in the Report Description pane.

Figure 7: Core Charge Identifier in Reports module

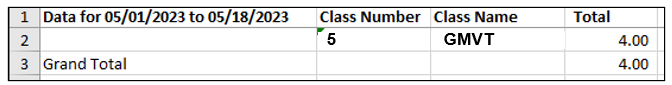

When the report runs, the Excel workbook reflects the core charge by showing the Class Number and Class Name given to the purchase(s).

Figure 8: Core Charge Class Number and Class Name in Excel report

If you have questions or suggestions about this information, contact support@paladinpos.com.