Note: This feature is for stores that use the Avalara AvaTax™ service with Paladin.

Note: If you see the tax subtotal on the main Invoice screen, Avalara isn’t enabled. Only the pre-tax subtotal is shown in the bottom-right corner of the screen when Avalara is enabled. If you just enabled Avalara, restart Paladin before testing an Invoice.

- In Paladin, on the top ribbon, select the Customers module.

- Enter or select a customer account from the Customer list. If needed, on the bottom ribbon of the module, click F1 Advanced Lookup and search for the customer account.

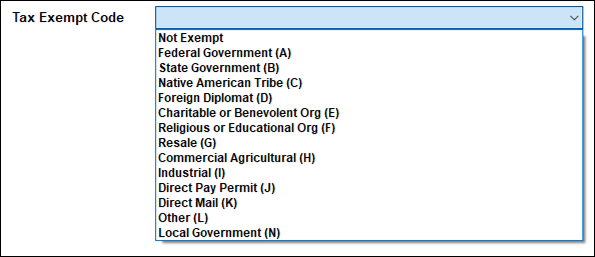

- In the Electronic tab, you can select a tax exemption reason for the customer account in the Tax Exempt Code list (Figure 1).

Figure 1: Paladin Customer/Tax Exempt Codes

- If a customer account’s State tax value (on the Customers tab) is set to None, the customer is tax-exempt, and the Tax Exempt Code (on the Electronic tab) must display a reason other than Non Exempt.

- If the State tax value and the Tax Exempt Code are incompatible, an informational message is displayed when you try to save customer account changes.

To give a customer tax-exempt status:

Note: These steps only apply to stores that use Avalara AvaTax™ with Paladin.

- In Paladin, on the top ribbon, select the Customers module.

- Enter or select a customer account from the Customer list. If needed, on the bottom ribbon of the module, click F1 Advanced Lookup and search for the customer account.

- On the bottom ribbon of the module, click F8 Tax.

- In the Tax Window, in the State column, select None.

- Click F12 Finish.

- Click the Electronic tab.

- In the Alternate Customer IDs pane, select a Tax Exempt Code.

- Click F12 Save.

If you have questions or suggestions about this information, contact support@paladinpos.com.

*Content is subject to change. For the most recent version, visit the Help Portal.

Printed on: 4/23/24